Cryptocurrency growth has experienced unprecedented growth in the past year.

After navigating a period marked by scandals and market downturns, the crypto industry has roared back to life in 2024 and into 2025.

The global cryptocurrency market cap currently sits at $3.28 trillion.

In this guide, we’ll discuss the biggest trends shaping the crypto market in 2025 and 2026. Let’s dive in.

1. Meme coins spark a new wave of investors

If you hadn’t heard of meme coins before, that likely changed when President Donald Trump launched his $TRUMP token on the Solana blockchain just days before his inauguration in January 2025.

This not only brought meme coins into the spotlight in mainstream media, but the move also highlighted their growing influence in the cryptocurrency market.

Other big-name meme coins like Shiba Inu (SHIB), Pepe (PEPE), and Dogecoin (DOGE) have grown past obscurity into high market cap assets with dedicated social communities.

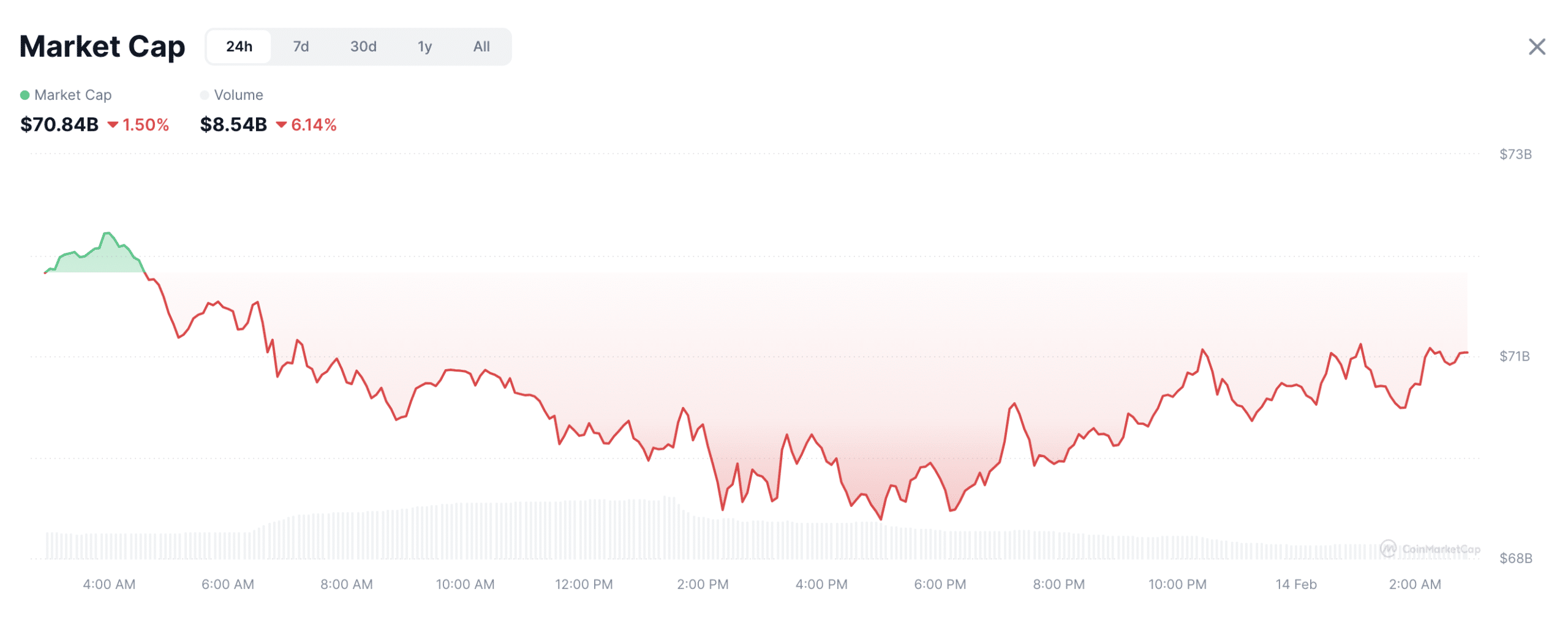

According to the latest CoinMarketCap data, the memecoin market cap currently sits at $69.26 billion.

That’s higher than USD Coin (USDC), the seventh most valuable cryptocurrency.

The reason for the surge in meme coins can largely be attributed to Solana’s Pump Fun.

The platform has democratized token creation and allows users to launch new meme coins with just a few clicks.

Pump Fun’s usage has never been higher. In the past 24 hours, 44,114 new tokens were created and launched.

Volume has steadily surpassed 40,000 per day in February 2025.

Many of these tokens leverage viral trends or celebrity endorsements to capture attention quickly. But the market remains highly volatile.

According to CoinGecko, the combined market cap of Solana meme coins is currently $11.4 billion.

As long as networks like Solana continue to attract retail investors, the future of meme coins looks brighter than ever.

2. ETF approval expanding beyond Bitcoin

The approval of Bitcoin exchange-traded funds (ETFs) in early 2024 was a historical moment in crypto and a huge spark for this bull run.

Bitcoin ETFs, such as BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FTBC), have attracted billions in inflows and provided investors with a regulated and accessible way to gain exposure to the world’s largest cryptocurrency.

By the start of 2025, Bitcoin ETFs collectively held over 1.13 million BTC. BlackRock alone manages 586,777 BTC, making it the largest single holder among ETF issuers.

The current market cap for Bitcoin ETFs is $116.1 billion. However, the ETF market is no longer just about Bitcoin.

The success of these products has asset management companies pushing for regulatory approval of alternative crypto-based investment products.

The US Securities and Exchange Commission also approved Ethereum ETFs. However, they have yet to see the level of activity as Bitcoin.

The current Ethereum ETF market cap is $8.43 billion. We are seeing a new wave of filings targeting altcoins like Solana (SOL), Ripple (XRP), and Cardano (ADA).

Some firms are even pushing for meme coin ETFs with filings for Trump, BONK, and Dogecoin.

While it’s unlikely to see these meme coins gain SEC approval, big names like Solana, Ripple, and Cardano all have a strong case.

For starters, Grayscale filed for a spot Solana ETF on January 28, 2025. Approval timelines are uncertain, but analysts project that an approved Solana ETF could attract between $3 billion and $6 billion in net assets during its first year of trading.

Ripple’s XRP token is also gaining traction in the ETF space. Multiple asset managers, including Grayscale and Cboe BZX, have filed for XRP ETFs this year.

Analysts estimate that an approved XRP ETF could see inflows ranging from $3 billion to $8 billion within its first year.

Grayscale also recently filed for a spot Cardano (ADA) ETF on February 10, 2025. After the announcement, ADA’s price surged nearly 15%.

If approved, this ETF would provide regulated exposure to Cardano, potentially driving further adoption and liquidity for the platform.

With over 60 new crypto ETF filings this year, it’s clear mainstream financial markets are ready to integrate cryptocurrency moving forward.

3. AI in crypto

AI has been the focal point of the tech and business world for the past 18-24 months. And it’s finally making its way into cryptocurrency.

Specifically, AI tokens are cryptocurrencies that directly support AI-based projects, ventures, applications, or services.

For instance, NEAR Protocol (NEAR) is the highest-valued AI token. It began as a crowdsourced AI platform and quickly grew into a complete blockchain platform to fix the problem of paying collaborators.

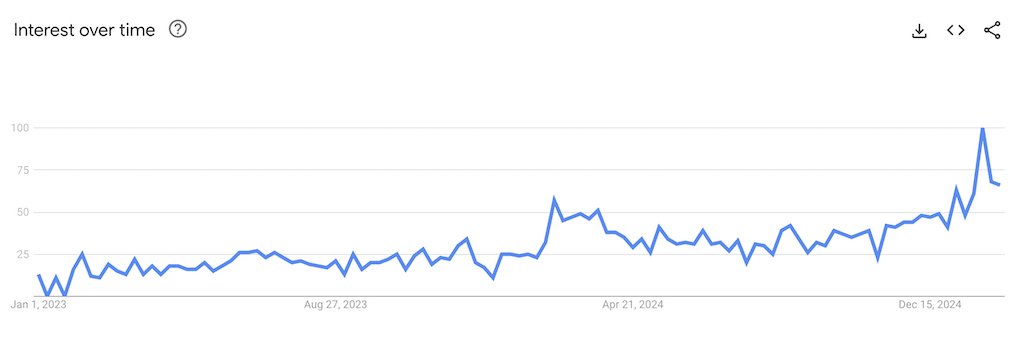

And it’s clear that these tokens will be mainstream soon enough. Search interest in “AI Tokens“ has grown significantly over the past five years, reaching its highest levels toward the end of 2024 into 2025.

And the growth in the space supports this data. In March 2024, there were approximately 90 AI tokens.

Today, there are 731 AI coins, representing an increase of 712% in just 11 months.

So, what does this mean for crypto investors?

Finding the right angle of AI to invest in will make all the difference for crypto investors.

For instance, a promising sector is AI agent tokens, which are tied to autonomous AI agents capable of performing tasks without human intervention.

These agents can analyze large amounts of data, manage decentralized finance (DeFi) portfolios, and even optimize blockchain operations.

And the market for AI agent tokens has surged recently. As of February 2025, the combined market cap of these tokens is

$7.14 billion. But there is no denying the potential for growth here.

Gracy Chen, CEO of Bitget, predicts that AI agent tokens could reach a total market cap of $60 billion by the end of 2025.

This potential surge is largely driven by their ability to automate complex tasks like trading and portfolio management while reducing reliance on human oversight.

Chen also predicts crypto exchanges will launch their own AI agents to automate tasks in daily operations and customer service.

4. Ethereum continues to lose market dominance

Ethereum has long been the second-largest cryptocurrency by market capitalization and the leading platform for decentralized applications (dApps), DeFi protocols, and NFTs.

However, as we move through 2025, Ethereum’s dominance in the crypto market is steadily declining.

As of today, ETH’s market dominance is 10%, the lowest level since March 2020.

In the past, Ethereum has maintained a dominance of 18% to 22% – especially during bull runs.

But due to the rise of competitors like Solana and the rise of Layer-2 blockchains, the network’s dominance faces huge risks moving forward.

Layer-2 platforms such as Arbitrum, Optimism, and Base collectively hold over $51.5 billion in value.

Basically, these platforms are more efficient because they process transactions off-chain before settling them on Ethereum’s mainnet.

While this has alleviated some pressure on Ethereum, it has also diverted activity and transaction revenue away from its base layer.

For instance, Ethereum’s transaction revenue dropped by 18% in Q4 2024 due to increased reliance on Layer-2 solutions.

Ethereum’s high gas fees and scalability challenges have created opportunities for competitors like Solana, Avalanche, and Cardano.

Despite these challenges, Ethereum remains a leader in DeFi and tokenization projects. And while the price will still increase during bull runs, faster-growing competitors like Solana could potentially overtake it.

5. More control over user data with decentralized identity (DID)

Decentralized Identity (DID) is changing how individuals manage their digital identities, giving users increased control over their personal data.

In the cryptocurrency space, DID significantly enhances security by minimizing the risk of hacks or unauthorized access to users’ crypto holdings.

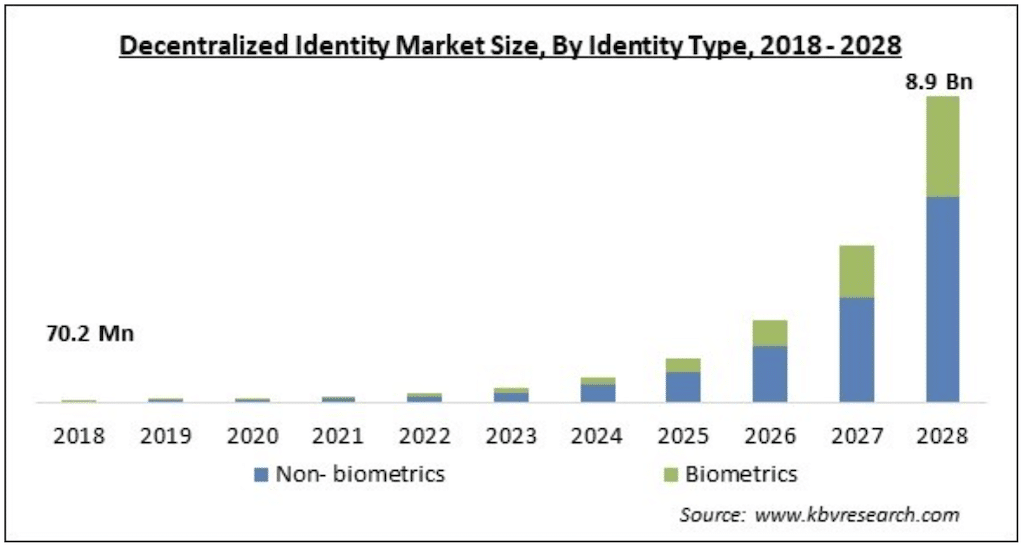

The global decentralized identity market is projected to reach $8.9 billion by 2028 at a 78.5% CAGR.

With data breaches exposing over 8.2 billion records in 2023 alone, the demand for secure, user-controlled identity systems has never been greater.

Over 353 million individuals were affected by data compromises in the U.S., while global numbers are even higher when including worldwide breaches.

That’s where Decentralized Identity comes in. DID leverages blockchain technology and cryptographic tools to create a self-sovereign identity system.

Unlike traditional centralized systems where companies store user data in vulnerable databases, DID allows users to hold and manage their own credentials securely.

For example, a user applying for a DeFi loan can present a verifiable credential that proves their KYC compliance without disclosing unnecessary personal details.

The DeFi platform can cryptographically verify the credentials on the blockchain to increase both security and privacy.

It will be more common to see DID used across the crypto space in 2025 and beyond.

It eliminates the need for centralized login credentials on crypto exchanges, which directly reduces the risk of phishing attacks.

Users can also access multiple DeFi platforms using a single decentralized identity rather than passing KYC checks.

As Web3 adoption grows, DID is expected to become a standard feature across crypto platforms.

Conclusion

That concludes our list of the top cryptocurrency trends shaping 2025.

The crypto market is poised to become more mainstream this year with ETF expansion. However, challenges such as Ethereum’s declining dominance and increasing regulatory scrutiny remind us that the industry remains as unpredictable as ever.

It will be interesting to see how things unfold moving forward.